Artificial intelligence (AI) is advancing at a pace few could have predicted. From powering everyday tools like chatbots to driving breakthroughs in healthcare, finance, and climate modelling, AI’s potential feels limitless. Behind the scenes, the technology depends on one thing above all else: compute power. The servers, processors, and data centres that make up AI compute infrastructure are now among the most energy-hungry systems on the planet.

For investors, this creates an important question: how can we meet the soaring demand for compute without adding to global emissions? The answer lies in combining AI infrastructure with renewable energy, and it’s where forward-looking investors now have an exciting role to play.

What is AI Compute Infrastructure?

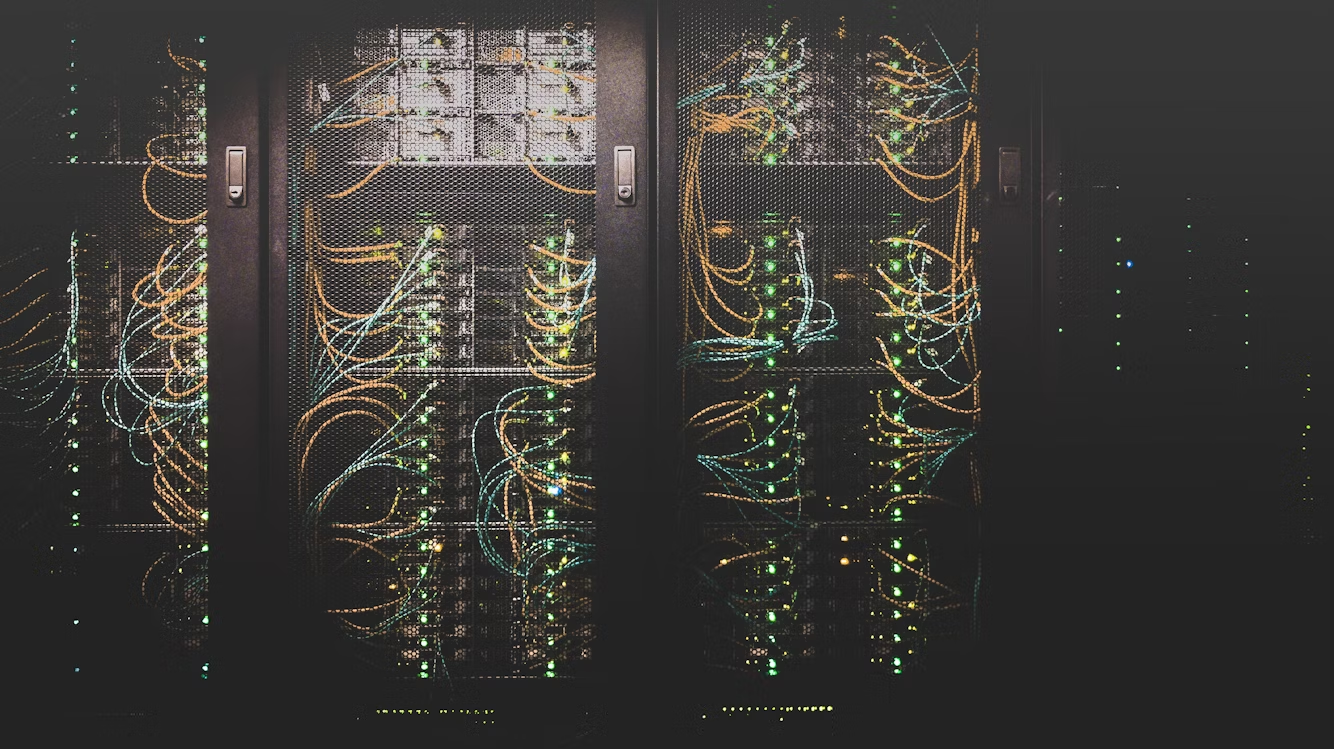

AI compute infrastructure refers to the physical and digital backbone that powers artificial intelligence. This includes data centres, high-performance GPUs, specialised processors, and cloud-based environments capable of handling massive amounts of data.

Unlike standard IT systems, AI workloads are exceptionally resource-intensive. Training large-scale models can consume vast amounts of electricity, sometimes equivalent to powering thousands of homes. As adoption accelerates, the need for efficient and sustainable compute capacity will only increase.

For investors, this makes AI compute infrastructure both a technological driver and a capital-intensive industry with long-term growth prospects.

Why Energy is at the Heart of AI Growth

The global surge in AI adoption comes with a hidden cost: rising energy consumption. AI models are not only complex but also continuous, requiring repeated training, fine-tuning, and deployment at scale. Traditional fossil-fuel energy grids cannot sustainably handle this demand without driving up emissions.

This is why powering AI compute with renewable sources is critical. By integrating solar, wind, and other clean technologies into AI data centres, the sector can grow without exacerbating climate challenges. For investors, this represents more than just a moral imperative. It’s a market opportunity to back the infrastructure that will define both digital and environmental futures.

Opportunities for Investors

Investing in AI compute infrastructure offers exposure to two of the world’s most transformative megatrends: artificial intelligence and renewable energy. Instead of treating them as separate markets, you can capitalise on their convergence.

Some of the most compelling opportunities include:

- Backing renewable-powered data centres that reduce reliance on fossil fuels.

- Supporting energy-efficient technologies that lower AI’s carbon footprint.

- Funding hybrid projects that pair clean energy production directly with compute facilities.

Historically, this type of investment required deep capital reserves and complex partnerships. Institutional investors and tech giants dominated the space, leaving most retail investors on the sidelines. But innovation is changing the landscape.

Today, renewable-powered AI compute infrastructure can be accessed through emerging investment platforms that lower entry barriers. This allows individual investors to participate in a sector once reserved for billion-dollar funds. At the same time, it creates a dual impact:

- Earn returns from one of the fastest-growing areas in technology.

- Directly supporting the transition to clean energy.

The demand is only strengthening. AI adoption shows no sign of slowing, meaning energy consumption will rise. Investors who align with renewable-powered solutions position themselves at the forefront of solving this challenge while benefitting from its growth.

Risks and Considerations

Like any emerging market, AI compute infrastructure comes with risks. Demand for AI technology can fluctuate based on economic cycles, technological breakthroughs, or regulation. Data centres are also subject to compliance standards around carbon usage and grid reliance, which may impact profitability.

Additionally, energy infrastructure projects often involve technical and logistical complexity. This makes due diligence essential when choosing where and how to invest. The opportunity is significant, but careful evaluation is critical to long-term success.

EcoYield’s Role in Sustainable AI Compute Infrastructure

EcoYield provides a new way for investors to participate in this opportunity. Through its green energy investment platform, we allow individuals to support sustainable AI compute infrastructure projects while benefiting from the growth of two rapidly expanding markets.

By tokenising access to real-world infrastructure and setting low minimum investment levels, we make what was once exclusive to institutions accessible to everyday investors. The platform emphasises transparency, real-asset backing, and measurable environmental impact, giving you confidence that your capital is driving both returns and positive change.

EcoYield bridges the gap between financial growth and sustainability, enabling you to play an active role in powering the AI revolution responsibly.

What does this mean?

AI compute infrastructure is becoming one of the most important building blocks of the modern economy. But powering its rise sustainably is a challenge that demands immediate solutions. For investors, this is more than just a financial opportunity. It’s a chance to support innovation while accelerating the global transition to green energy.

With platforms like EcoYield, investing in AI compute infrastructure is no longer reserved for institutions. It’s an accessible, forward-looking option for those who want their capital to contribute to a future that is both technologically advanced and environmentally responsible.